Get the free tr1 form

Show details

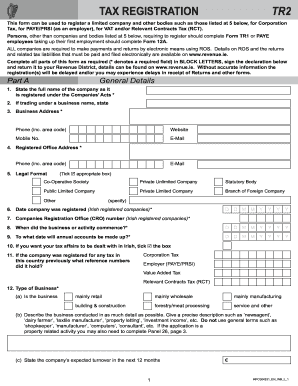

TAX REGISTRATION TR1 This form can be used by 1. An individual - complete parts A 1 A 3 A 4 and B C D and/or E as appropriate. 2. A partnership trust or unincorporated body - complete parts A 2 A 3 A 4 and B C D and/or E as appropriate to register for Income Tax VAT as an employer for PAYE/PRSI or for Relevant Contracts Tax RCT. Note if you are completing Part A2 and/or C of this form on registration you will be required to make payments and returns by electronic means using ROS* Details on...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tr1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tr1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tr1 form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tr1 form 2023. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

How to fill out tr1 form

How to fill out tr 1 form?

01

Make sure to have all the necessary information and documents ready, such as your personal identification details, financial records, and relevant supporting documents.

02

Begin by carefully reading the instructions provided on the tr 1 form to understand the requirements and sections that need to be completed.

03

Start filling out the form by entering your personal details, such as your name, address, contact information, and social security number.

04

Proceed to provide the required information regarding your income, including details of your employment, business, or any other sources of income.

05

If applicable, input information about your spouse or dependents, including their names, social security numbers, and any financial details relevant to their situation.

06

Move on to the section where you need to declare any deductions or exemptions you may be eligible for. This could include items such as mortgage interest, educational expenses, or medical expenses.

07

Double-check all the information you have entered to ensure accuracy and completeness. Make any necessary corrections before proceeding.

08

Finally, sign and date the form as required and submit it according to the instructions provided.

Who needs tr 1 form?

01

Employees: Individuals who are employed by a company or organization and receive income through wages or salaries.

02

Self-employed individuals: Those who work for themselves and are not employed by any company or organization.

03

Individuals with multiple sources of income: People who have income from more than one job or any other additional sources of income.

04

Individuals with deductions or exemptions: Those who are eligible for certain deductions or exemptions, such as those related to mortgage interest, education expenses, or medical expenses.

05

Married individuals filing jointly: Couples who are married and choose to file their taxes jointly in order to benefit from certain tax advantages.

06

Nonresidents or foreign individuals: Individuals who are not citizens or residents of the country in which the tr 1 form is applicable but are required to report their income earned within that jurisdiction.

Fill how to no download needed previous e fill tr1 form : Try Risk Free

People Also Ask about tr1 form

How long does it take to transfer property ownership UK?

How much does it cost to transfer a property title UK?

How much does it cost to transfer ownership of a house UK?

What is a TR1 share of freehold?

What is a TR 1 form?

How do I transfer property from one person to another UK?

Do I need a solicitor to transfer ownership of a property UK?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file tr 1 form?

TR 1 form is a form used by companies to inform Companies House of the details of any changes to their company's directors, secretary, registered office or other officers. All companies registered in England and Wales must file this form.

How to fill out tr 1 form?

1. Gather the required information: You will need the following information to complete a TR-1 form:

•The name of the corporation

•The corporation's address

•The name of the registered agent

•The registered agent's address

•The state of incorporation

•The date of incorporation

2. Fill out the form: Fill out the form using the information you have gathered. Be sure to complete all of the required fields.

3. Sign and date the form: At the bottom of the form, there will be a signature and date section. Sign the form and include the date.

4. Submit the form: Submit the form to the appropriate state agency. Depending on the state, you may need to submit the form in person, by mail, or online.

When is the deadline to file tr 1 form in 2023?

The deadline to file a TR1 form in 2023 is 31st December 2023.

What is the penalty for the late filing of tr 1 form?

The penalty for the late filing of a TR1 form is a daily penalty of up to £5,000.

What is tr 1 form?

TR-1, or Transparency Report 1, is a form used by certain regulated companies and financial institutions to report their significant shareholding positions to the relevant financial authority or regulatory body. This form is required to disclose certain details such as the identity of the shareholder, the date of the transaction, and the number of shares held. The purpose of this form is to ensure transparency and enable regulatory bodies to monitor and regulate the ownership and control of significant shareholdings in companies.

What is the purpose of tr 1 form?

The purpose of the TR 1 form can vary depending on the context, as there are different forms with similar names used in various industries and countries. However, one commonly known TR 1 form is used in the United Kingdom for the notification of major holdings in publicly traded companies.

The TR 1 form is typically filed by individuals or institutions that acquire or dispose of significant shareholdings in a UK-listed company. It is a requirement under the Disclosure and Transparency Rules, which are part of the Financial Conduct Authority's regulations.

The form provides information such as the name of the company, details of the shareholder, the date of the transaction, and the percentage of shares held before and after the transaction. This helps ensure transparency and enables the market and relevant authorities to monitor and assess the ownership and control of publicly traded companies.

Where do I find tr1 form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tr1 form 2023 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the tr 1 form in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit tr1 form pdf on an Android device?

The pdfFiller app for Android allows you to edit PDF files like tr1 form download. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your tr1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tr 1 Form is not the form you're looking for?Search for another form here.

Keywords relevant to tr1form

Related to tr1 online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.